FTX and the collapse of customer trust in crypto

FTX, a crypto exchange, had become a media darling. Its founder, Sam Bankman-Fried (SBF), is a 30-year old who resides in the Bahamas. In the past, he had proclaimed he’d give away most of his earnings to philanthropic causes (and was one of the Democratic party’s largest donors). He was featured on Fortune magazine’s cover earlier this year with the title “The Next Warren Buffett?”.

The crypto community viewed FTX as an industry leader, and thus, its downfall so much more surprising. Did I think that there would be turbulence in crypto as this nascent industry weeded out winners and losers? Yes. Did I think one of the premier US exchanges would be one of them? No.

What happened

FTX had an exchange arm, where customers could deposit their money and buy/sell crypto. FTX also had an affiliated company—called Alameda—that traded crypto. FTX used customer deposits to fund trading for Alameda, its trading arm. This is a big no no.

When the markets went into turmoil this past year, Alameda lost money. Last week, a bunch of people tried to withdraw their money from FTX. FTX didn’t have enough to cover all the withdrawals, and people were left with nothing.

Things snowball

Then a bunch of other things start coming out. Binance (a large crypto exchange) said it would buy FTX. Then after doing like a days’s worth of due diligence, it backed out saying FTX’s issues “are beyond our control or ability to help“.

SBF came back on Twitter after being silent for a few days saying that he was sorry and that FTX’s US arm was fine and it was just the international arm that was facing Iiquidity issues.

The next day SBF and FTX (including FTX US) file for bankruptcy and SBF resigns. Then over the weekend, there was a large “unauthorized withdrawal of funds” (I’ve read reports of anywhere from $400M - $1B). As of writing this, it’s unclear who is at fault, but some have speculated it was an inside job.

Bank run

This was essentially a bank run. Banks/institutions hold people’s money in accounts. People don’t trust the institution anymore. Everyone pulls their money out at once. The institution doesn’t have enough to cover all the withdrawals at once.

But the difference is that in the US, bank deposits are FDIC insured (up to $250K). FTX was not.

Banks do use customer deposits to do other things, like lend out for mortgages. But turns out, mortgages are generally (unless there’s a bunch of bad loans made, ex. 2007-2008) more reliable to be paid back than trading in volatile cryptocurrencies. Also, banks are required to hold a certain amount of cash reserves relative to deposits. Crypto isn’t regulated in the same way. (At least not right now, but I’m guessing there will be a lot more regulation coming after this.)

What’s else is next

I unfortunately think that there will be more domino and residual effects. I’ll be especially watching what happens with BlockFi, another crypto company, which had a line of credit with FTX and announced a pause in withdrawals as well.

Other crypto exchanges, like Coinbase, have come out to try to assuage people that they hold customer deposits 1:1 for one and are stable.

I will be honest and share that I personally moved my Coinbase crypto into a cold wallet. In my opinion, Coinbase is one of the more legitimate crypto companies out there, given that it is publicly traded and has audited financials. BUT, that hasn’t stopped people before. (ahem… Enron, sub-prime mortgages…).

Is crypto done?

Being honest here, this is the first time where I’ve seriously thought that I should cut my losses and cash out at this point. The volatility and lack of regulation was a rude awakening this week.

But long term, I do still believe in its power and ability to evolve the financial industry. So I’ve decided to wait and see for now. But I think it will be a long time before the industry regains customer trust.

Bonus thoughts

1) I am so glad that I never got around to this task I had on my to do list for a long time—“Set up BlockFi and FTX accounts to test out platform”. Sometimes procrastination has its benefits 😊

2) Apparently Michael Lewis (MoneyBall, The Big Short) had been following FTX and SBF around for his next book. Well, he just got a twist ending. I’m sure we’ll have plenty of documentaries/miniseries about these events in the coming years.

3) If it’s confusing to follow which part of FTX did what and how they’re interrelated. Don’t worry. It’s not you. Look at their org chart. 🤯

4) Also this was funny

Money & Crypto

Inflation down to 7.7% (WSJ)

Texas judge strikes down Biden’s student debt cancellation (NYT)

Facebook/Meta lays off 11,000 employees (NBC News); here are other notable lay offs so far this year (CNBC)

When companies became valued at $1T and then fell below $1T (Visual Capitalist)

Etc.

World Cup starts at the end of this week

“A parent’s typical day, as envisioned by my child’s preschool”

Anthony Fauci to step down from government in December

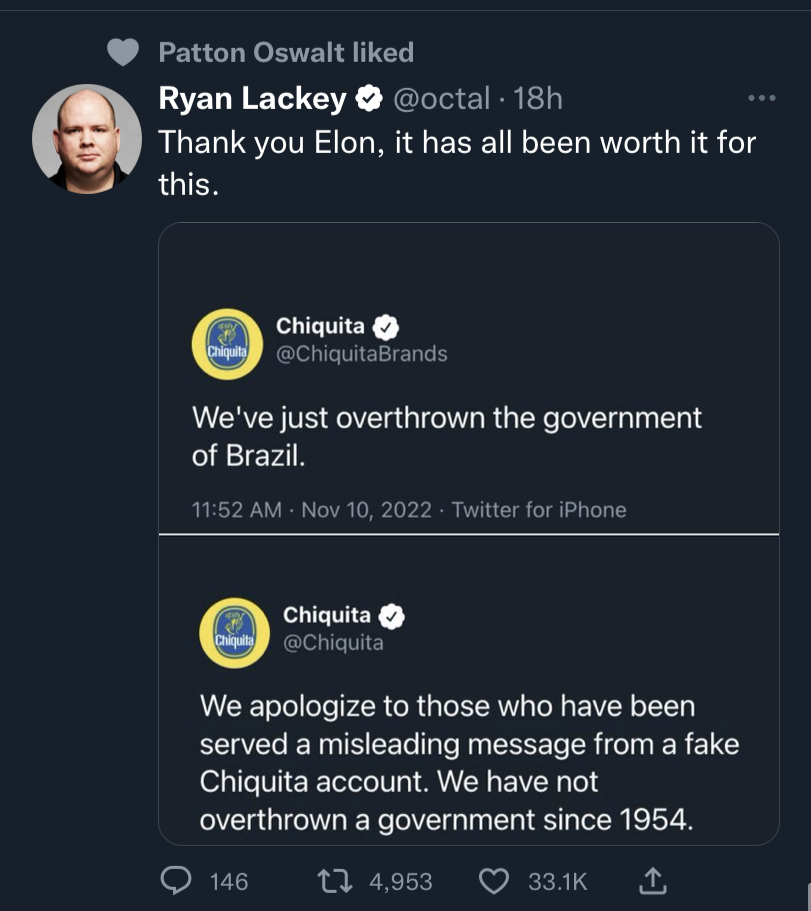

Twitter tries out its $8 subscription for a blue check mark. Chaos ensues as a bunch of impersonation accounts are created. See examples below. ( I tried to find the original links for some of these but couldn’t anymore. I’m guessing they got taken down.)

Reader Feedback

Email walletstreetpodcast@gmail.com to share your questions/comments.

Disclaimer: All opinions are my own. The content on this site and on the podcast does not constitute financial, legal, accounting, tax, or investment advice.