05/09/2022: Weekly Briefing

I’ve only gotten through 10% of my 100 conversations so far, but I’ve already found so many wonderful insights. One that stood out to me so far is consistent comments about fear. The fear of investing, fear of losing money, fear of spending money, fear of markets going down, fear of not understand if we’re doing the right thing.

This made me aware of my own fears of investing and how I have had money in cash probably for longer than I should have because I’m worried about losing it in the markets. It’s only been in the last couple of years that I’ve really pushed myself beyond that.

But it is so understandable to feel this way.

Many people my age became financially independent when the economy was melting down and panic was everywhere. Trying to find a job in 2009 scarred me and everyone remembers the stories of people losing all of their savings.

We are bombarded with stories of greedy investors like Enron, con men like Bernie Madoff, and crazy financiers (eg. American Psycho)...and the list goes on…Theranos, WeWork, the London Whale, crypto hacks…

The financial industry uses jargon that makes me feel like I’m in an Alice in Wonderland maze where I don’t know what should be up and what should be down.

There are so many conflicting opinions out there that it’s hard to know what to listen to. On the one hand I’ve been told to diversify; on the other I’ve been told to focus on certain key investments.

The paradox of choice is visceral when trying to figure out which investment to choose. There are so many options–single name stocks, funds, mutual funds, ETFs, REITs, index funds, target date funds, futures, commodities, SPACs, etc. How can you choose?!

I’m not sure how to solve this or what it means yet, but I do promise to keep trying to figure it out and sharing what I find here.

And please let me know if there is something that you fear in investing? Would love to hear from you!

Money & Crypto

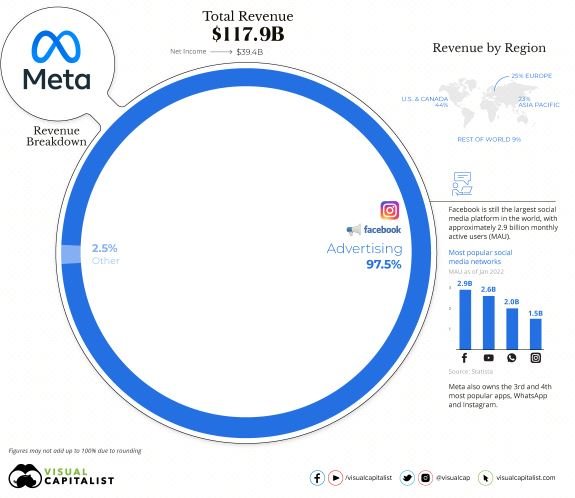

A visual breakdown of how big tech companies make their revenue by segment(Visual Capitalist). I am floored that 52% of Apple’s revenue is from iPhone sales and 98% of Meta’s revenue is from advertising. 98%!!!!

Where to invest with stocks and bonds falling (WSJ)

Jared Kushner’s has a new fund that will invest some of the Saudi’s sovereign wealth fund into Israel (WSJ)

How online banks are providing higher rates for deposits (WSJ)

EU probing into Apple Pay and possible breach of antitrust (Economist)

Which countries’s real estate markets are most at risk when interest rates rise (Economist)

WisdomTree coming out with its own crypto wallet (The Block Crypto)

Bitcoin falls to $34k. (The Block Crypto). While this is ~50% down from a 2021 high of $69k, I’d still like ro remind everyone that 2 years ago the price was $9.5K…

Instagram piloting NFTs…? (The Block Crypto) This should be intersting to watch.

100 Conversations Project

I’ve had so many wonderful conversations so far talking with you about money & investing and can’t wait to keep going. I’ve learned so many tips and new ways of thinking about investing & personal finance. I’ll keep sharing more updated on what I’ve learned.

I have 5 slots still open for end of May; if you’d like to chat with me for 15 min, sign up for a time here.

Wallet set up

If you’ve been interested in buying crypto, but don’t know where to start, email me at walletstreetpodcast@gmail.com and I’ll set up some time to walk you through how to set things up.

Etc.

🎥 If you’re a fan of The Wire & David Simon, I recommend We Own This City, a miniseries produced by David Simon based on Justin Fenton’s book about the true story of courrption in the Baltimore Police Department in the years after Freddy Gray’s death. I just ordered the book and am excited to read that too… (Keep you posted on the tv adaption vs. book…)

🎧The real drama behind the Murdoch family and how HBO’s Succession gets it right

Clever tools to help deal with too many disorganized cables. These cables drive me BONKERS.

Podcast Pick of the Week

🎧I interviewed my dad who answered all my questions about the Kentucky Derby. He has worked in the industry for a long time and helped break down everything that goes behind the scenes of the famous race. Subscribe to the pod so you don’t miss future episodes!

Disclaimer: All opinions are my own. The content on this site and on the podcast does not constitute financial, legal, accounting, tax, or investment advice.