01/11/2022: Weekly Briefing

Hello reader! I’m setting the roadmap for this year and could use your help. Can you tell me your favorite things and suggestions for Wallet Street in 5 multiple choice questions? Click here.

Thank you!

Over the holidays I stumbled across the book “The Winning Investment Habits of Warren Buffett and George Soros” by Mark Tier at a family friend’s house. I am usually skeptical about any “how to get rich” books, so I had a healthy dose of cynacism going in. But I was curious what it said and skimmed it, and found a few tid bits, in the form of ‘7 sins of investing’. The author then explained how Warren Buffett and George Soros avoid these mistakes.

I don’t think I agree with all of them, but over the next few weeks I’ll be writing about some of these. For today I’ll just list them here.

The book says:

1. “Believing that you have to predict the market’s next move to make big returns.

Reality: Highly successful investors are no better at predicting the market’s next move than you or I.

2. The “Guru” belief: If I can’t predict the market, there’s someone, somewhere who can – and all I need to do is find him [or her].

Reality If you could really predict the future, would you shout about it from the rooftops? Or would you keep your mouth shut, open a brokerage account, and make a pile of money?

3. Believing that “inside information” is the way to make really big money.

Reality: Warren Buffett is the world’s richest investor. His favorite source of investment tops is usually free for the asking: company annual reports.”

[I would also add that it’s illegal and with all the electronic trading, it’s easy to trace these days…]

4. Diversifying

Reality: Warren Buffett’s amazing track record comes from identifying a half dozen great companies – and then taking huge positions in only those companies.

[This one really stumped me. I always thought diversification was best… but maybe concentrating on a few investments is a better approach? This is something I’ll explore more in the next few weeks.]

5. Believing that you have to take big risks to make big profits.

Reality: Like entrepreneurs, successful investors are highly risk averse and do everything they can to avoid risk and minimize loss.

[This makes me feel better as I am very risk averse and also want to avoid losses. I always assumed that this would prevent me from being a successful investor, but now, it makes me think this could be an asset. It emphasizes that preservation of capital is the most important. ]

6. The “System” belief: Somebody, somewhere has developed a system—some arcane refinement of technical analysis, fundamental analysis, computerized trading, Gann triangles, ,or even astrology—that will guarantee investment profits.

Reality: This is a corollary of the “Guru” belief—if an investor can just get his [or her] hand’s on a guru’s system, he’ll [or she’ll] be able to make as much money as the guru says he [or she] does. The widespread susceptibility to this Deadly Investment Sin is why people selling commodity trading systems make good money.

7. Believing that you know what the future will bring—and being certain that the market must “inevitably” prove you right.

Reality: This belief is a regular feature of investment manias. Virtually everyone agreed with Irving Fisher when he proclaimed: ‘Stocks have reached a new, permanently high plateau’—just a few weeks before the stock market crash of 1929. When gold was soaring in the 1970s, it was easy to believe that hyperinflation was inevitable. With the prices of Yahoo, Amazon.com, eBay, and hundreds of “dot-bombs” rising almost every day, it was hard to argue with the Wall Street mantra of the 1990s that ‘Profits don’t matter.’ “

Curious what your reactions are to these!

I’m coming back from the holidays where I made a very pointed effort to disconnect, so I am still catching up on everything I’ve missed and what’s been going on. Bear with me as I ramp back up…

Money & Crypto

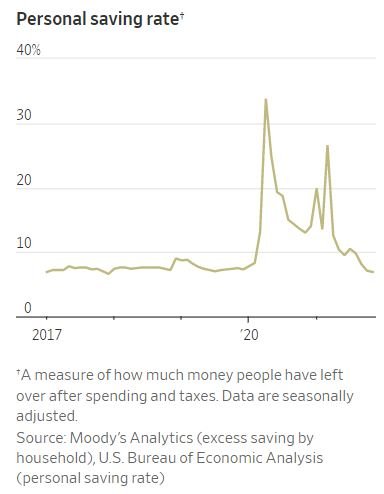

Americans saved during the pandemic. This chart above is kinda wild, but then when you look at the savings rate by bracket, it’s clear that the highest income brackets are pulling up this average.

Bitcoin price falls (CoinDesk)

PayPal exploring a stablecoin (The Block Crypto)

az16 (Andreesen Horowitz, famed VC investor) released a white paper on how it believes crypto should be regulated (az16)

OpenSea, NFT exchange, valued at $13B (NYT)

Take Two Interactive buys game maker Zynga for ~$12B (CNBC)

SEC looking to have better insight into large private ‘unicorn’ companies. I didn’t know this but apparently if a company has more than 2,000 investors the company has to register with the SEC. However, how you count that number of investors can be a little grey (ex. does a fund invested in a company count as 1 investor? Or should it could based on how individuals are invested in that fund) (WSJ)

Predictions that Fed will raise interest rates in 2022 (CNBC)

Etc.

📖 Chasing the Scream by Johann Hari was the most mind blowing book I’ve read recently. Everything I ever thought I knew about the war on drugs and addiction was turned upside down. I don’t think I can ever look at these topics in the same way again. I urge everyone to read this book! (and props to my co-host on Not So Silent Reading for putting it as one of her best books she read in 2021) This book was also the basis for the movie Billie Holiday vs the United States.

CES showcases the best and sexiest products and prototypes for the years to come…detergent for astronauts, a certified medical device tracker, new laptops, etc

Best fitness apps (I’m a loyal follower of Sweat, by Kayla Itsines, who I’ve been following for many many years now. She’s great!) (WSJ)

Novak Djokovic gets detained at Australian border because of COVID vaccine; judge overturns detention (WSJ)

Betty White, Sidney Poitier, Bob Saget passed away recently

Disclaimer: All opinions are my own. The content on this site and on the podcast does not constitute financial, legal, accounting, tax, or investment advice.